Is The New Record High In Stocks Irrational?

Published Friday, November 8, 2019 at: 7:00 AM EST

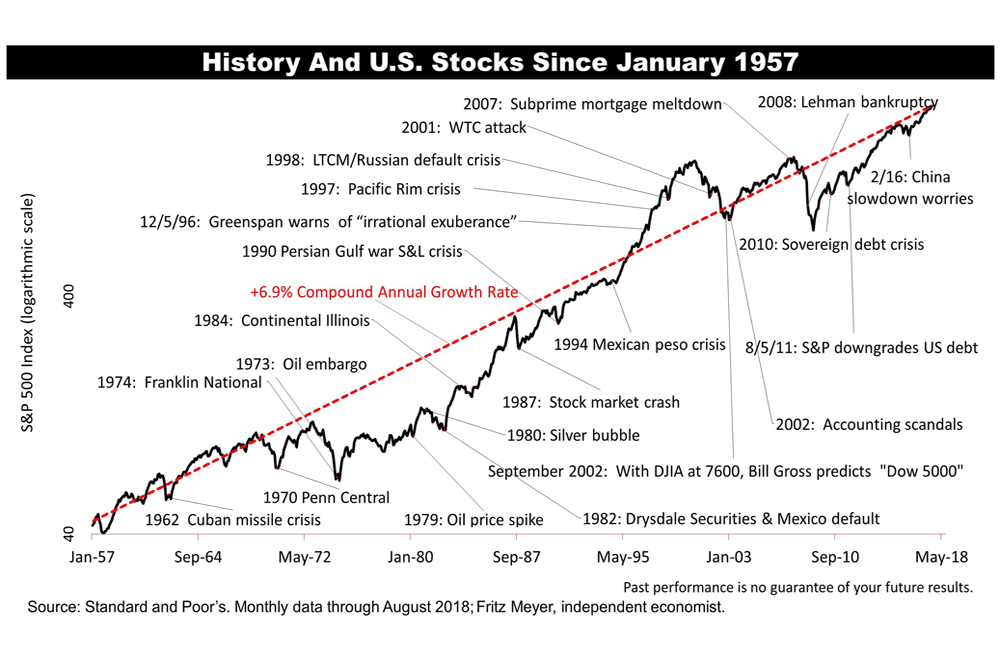

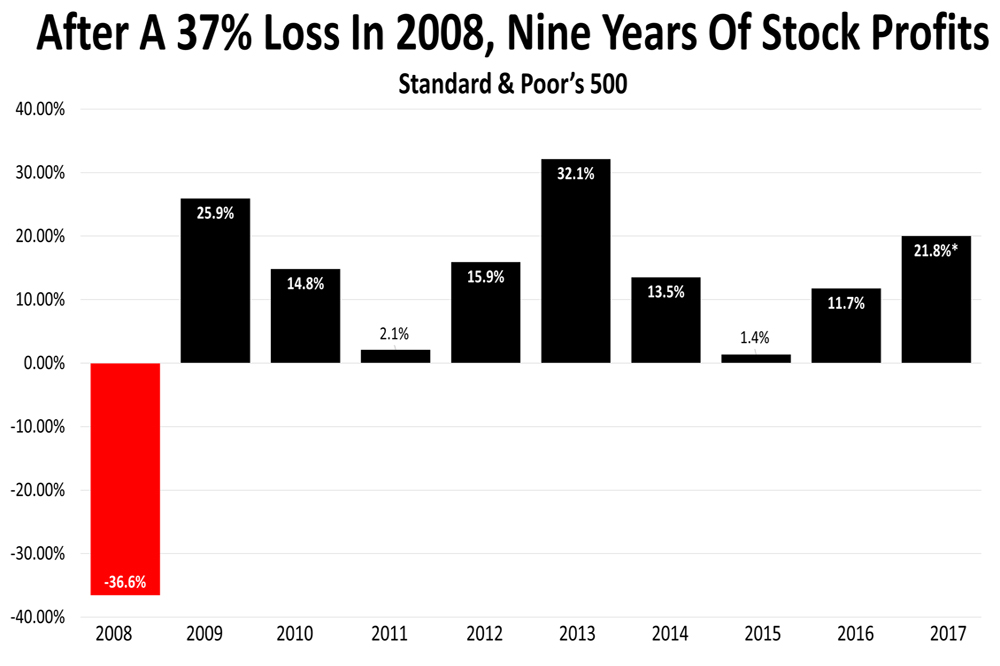

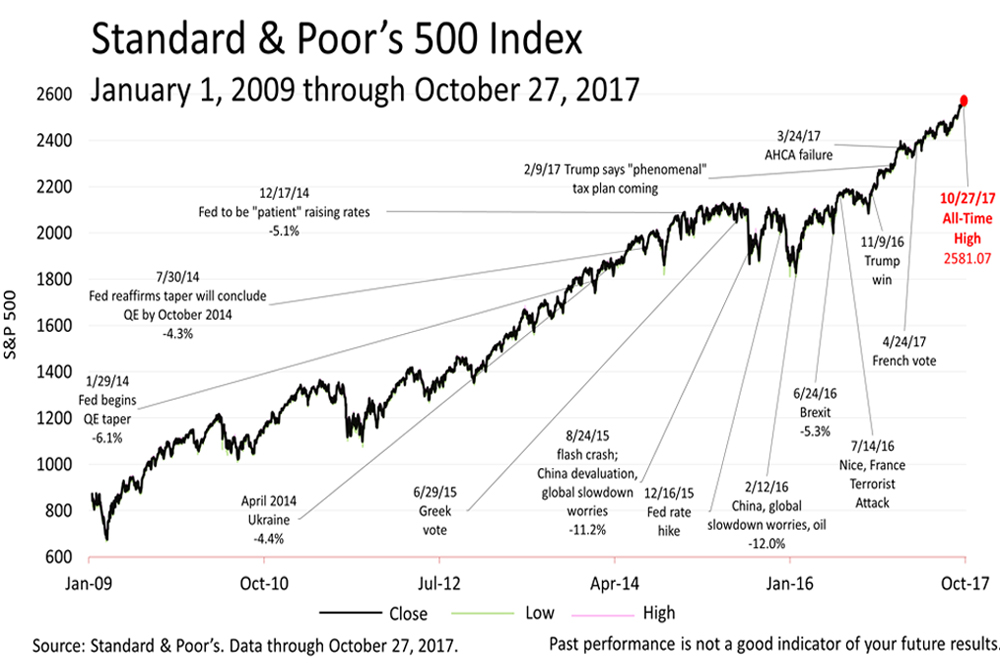

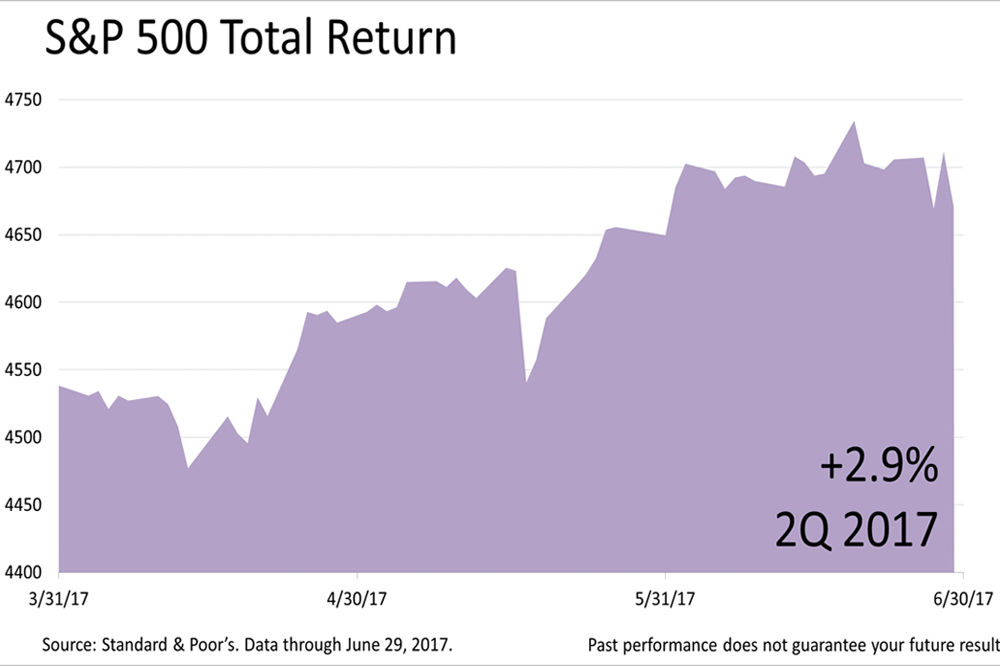

The Standard & Poor's 500 stock index, the key benchmark of current financial and economic conditions, closed at an all-time high for the second week in a row.

Is it irrational exuberance?

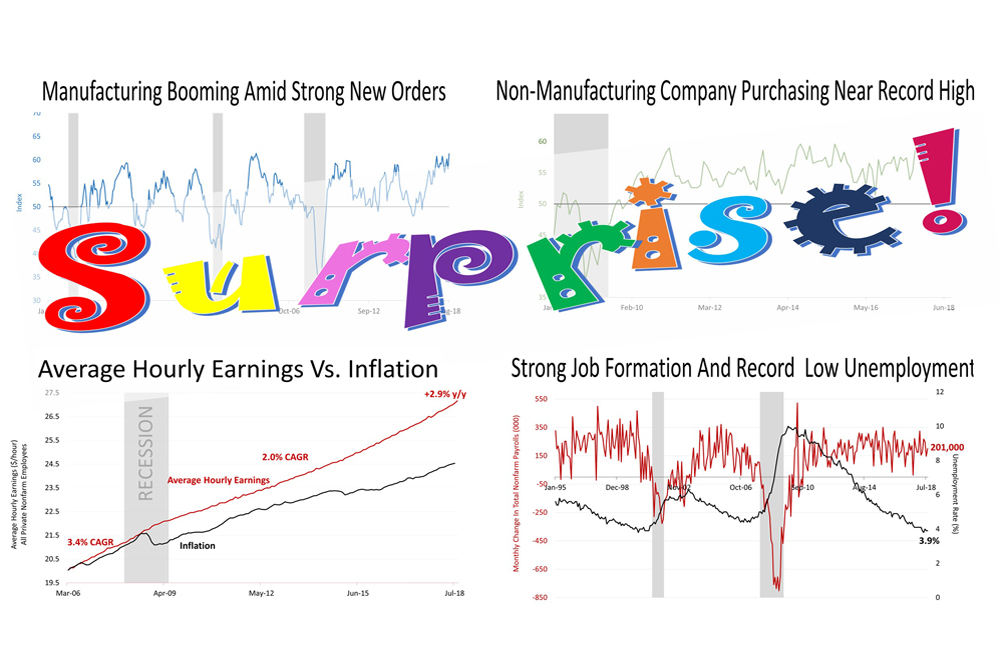

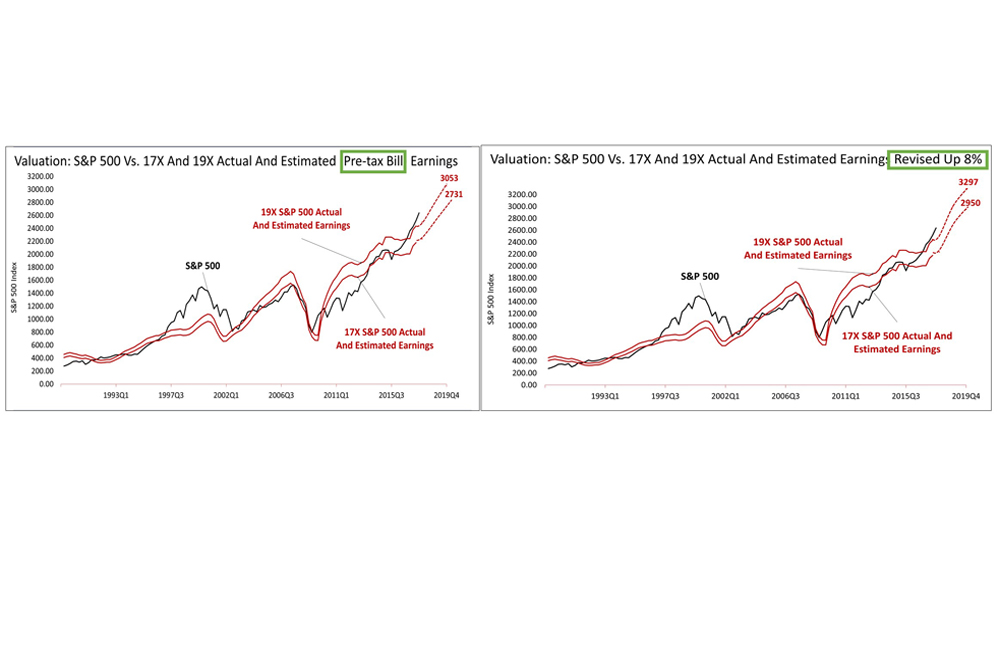

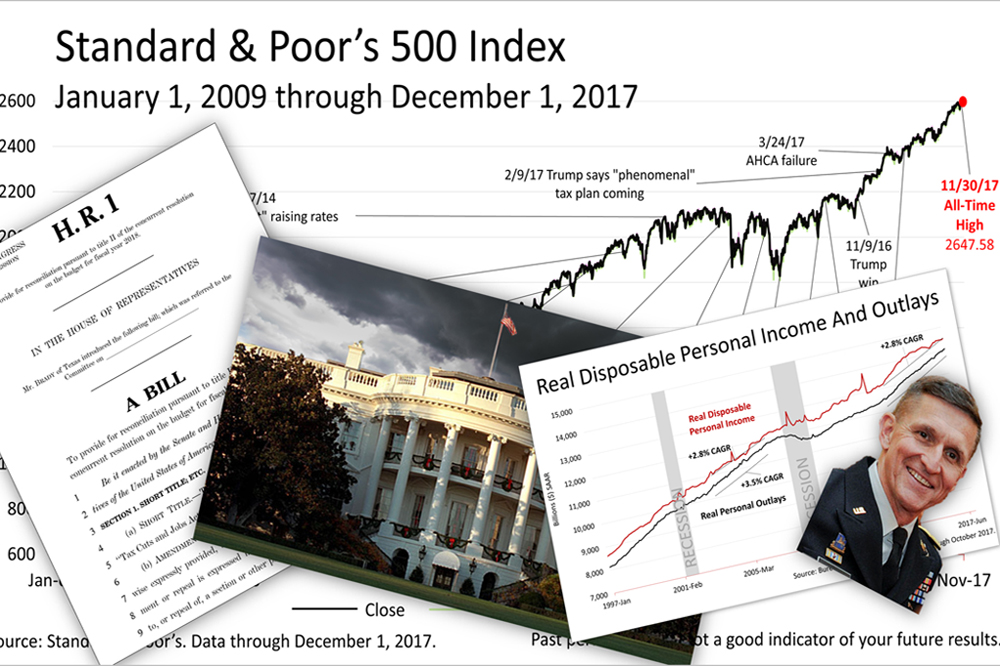

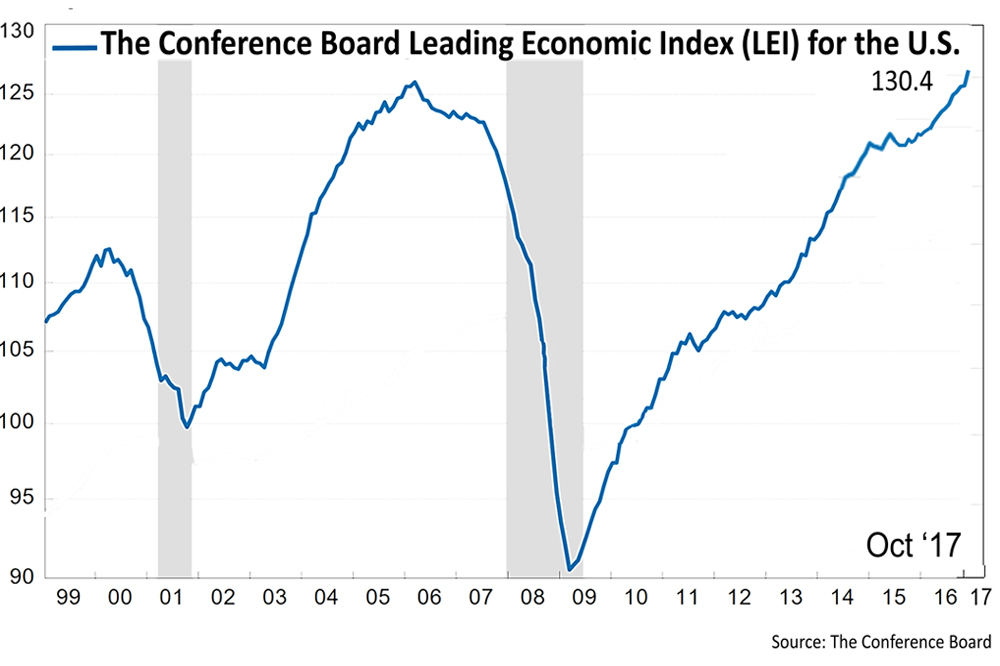

These four charts show the latest data on key fundamental economic factors driving financial market prices.

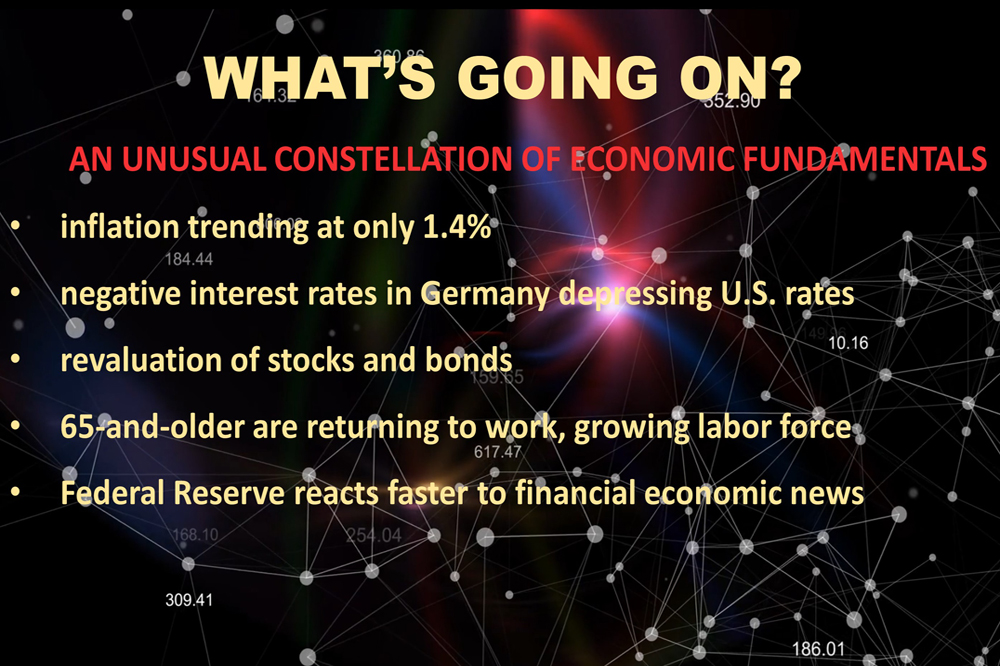

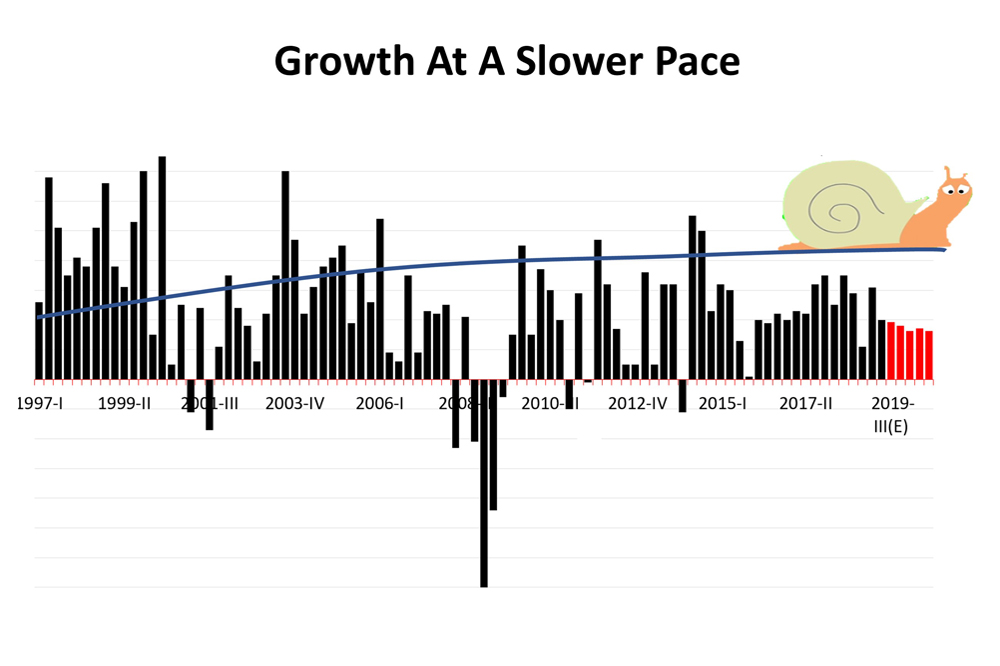

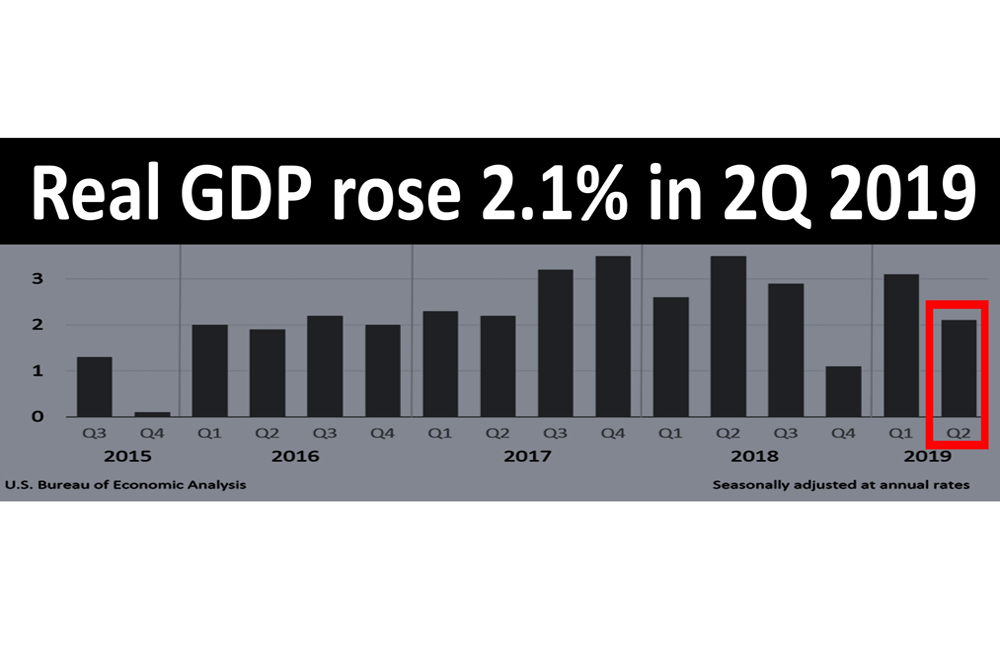

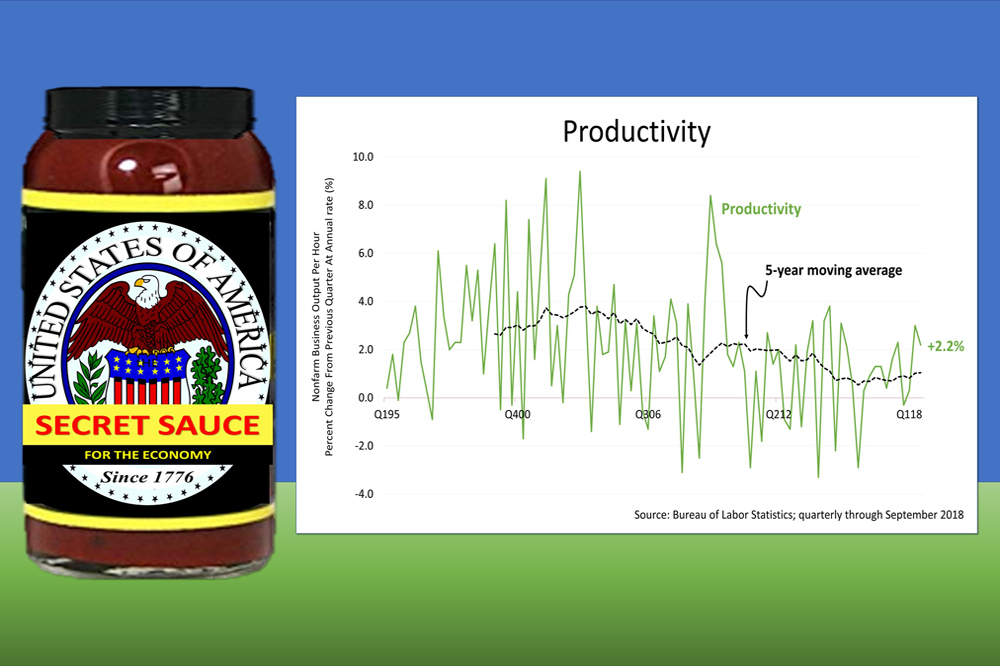

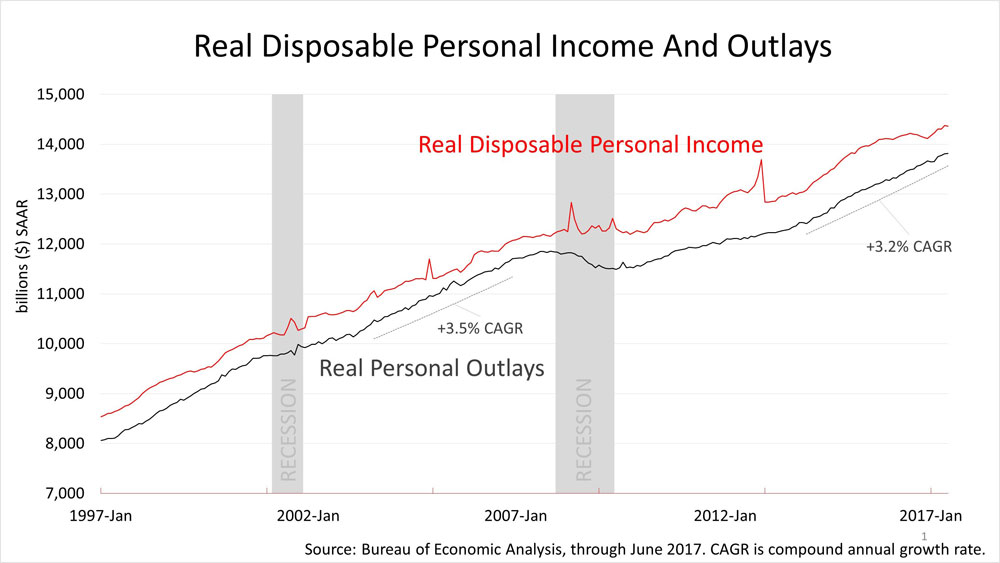

Third quarter economic growth reported by the U.S. Bureau of Economic Analysis came in at 1.93%. Three of the four factors in economic growth — business investment, net exports, and state and local government spending — did not contribute to growth but consumer strength offset them and was the source of the 1.93% quarterly growth rate for the U.S. in the third quarter of 2019.

Meanwhile, the manufacturing sector — which accounts for just 11% of U.S. growth — remained in recession but rebounded slightly last month, according to the latest data from the Institute of Supply Management. It may have bottomed.

The Federal Reserve's key lever in promoting growth, the yield curve, uninverted, indicating that fears of a recession may be overblown, and the financial obligations ratio — a key measure of consumers' free cash flow after paying monthly fixed expenses — remained near its strongest level in decades after ticking lower last quarter.

No one can predict the next move in the stock market. However, the latest economic data indicates that the record stock prices are pretty darn rational.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

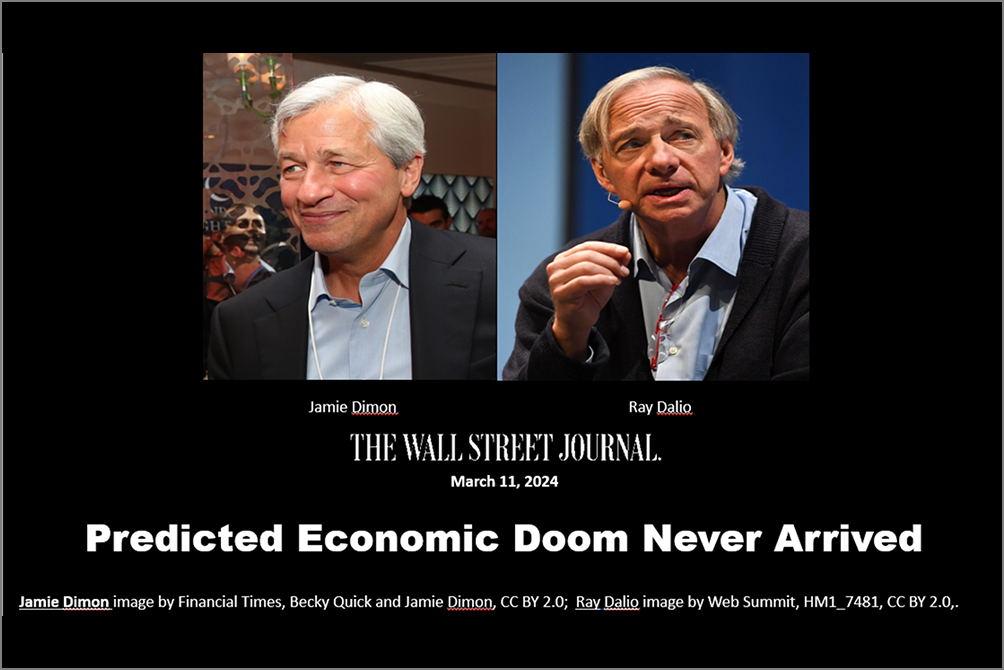

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding